We simplify complex customs processes

Are you looking to expand your business to the international market but feel overwhelmed by customs procedures? At GLS, we can assist you!

We act as intermediaries with customs, both nationally and internationally. We will advise you to ensure compliance with regulations, optimizing your shipments to the fullest. Additionally, we’ll assist you in determining cumbersome tariff classifications and provide you with tools for monitoring and obtaining the necessary customs documents. Your shipments are in good hands.

It’s so easy! Download the guide to export in 3 simple steps.

-

Standardized delivery times

-

Contact personnel in your local area

Contact personnel in your local area -

Tailored solutions for your business

-

Recipient’s digital signature

Recipient’s digital signature -

Real-time shipment tracking

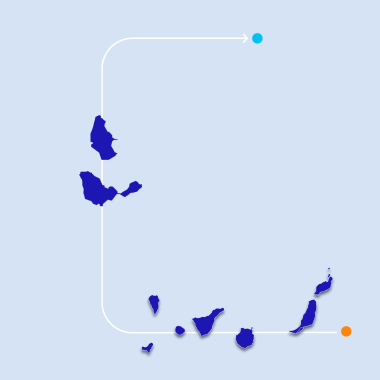

Customs brokerage

Customs brokerage

We offer customs brokerage services both nationally (Canary Islands, Ceuta, and Melilla) and internationally (Andorra, Great Britain, Norway, Switzerland, and other countries with customs regulations).

Processing of paperwork

Processing of paperwork

• Importation and exportation

• Submission of security documents

• Customs clearance traceability

• Declaration filing

• Fees and taxes

Consultancy and support

Consultancy and support

Guidance to enhance customs activities and ensure compliance with regulations, operation profitability, and time-saving measures.

Customs documents

Customs documents

Customs documents available to clients for proper management of their tax responsibilities.

Frequently Asked Questions about customs

Does GLS provide customs clearance solutions?

Yes. GLS supports both domestic and cross-border shipments with comprehensive customs clearance assistance. The company serves as a liaison between shippers and customs authorities in multiple regions worldwide, including European Union countries, Switzerland, Norway, the United Kingdom, Turkey, Serbia, San Marino, the United States, and several Asian markets.

GLS provides end-to-end customs brokerage services, which typically include:

- Preparation and management of required documentation

- Handling of duties and tax payments

- Ensuring compliance with local and international regulations

- Shipment visibility through real-time tracking and electronic proof of delivery

What is a customs broker?

A customs broker is an authorized specialist or firm that supports individuals and companies in transporting goods across international borders. They manage the regulatory requirements and administrative processes imposed by customs authorities.

Typical responsibilities of a customs broker include:

- Completing and filing all necessary import and export paperwork.

- Verifying that shipments comply with relevant trade laws and regulations.

- Assessing and settling applicable duties, taxes, and tariffs on behalf of clients.

- Liaising with customs officials to facilitate the release of goods.

- Providing guidance on product classification, valuation, and country of origin to ensure accurate duty assessment.

Why do I have to pay for a parcel from an international origin?

Items shipped from another country must go through customs procedures when entering the destination country. As a result, recipients may need to cover import duties, taxes, and handling fees related to customs processing.

The amount payable depends on factors such as the declared value of the goods, their category, and the import rules applied by local authorities.

What information does a consignor need before sending a parcel?

Prior to dispatching a shipment, the sender must obtain the recipient’s full contact information. This typically includes the complete residential or business address, an email address, and a valid phone number.

Providing accurate details is crucial for smooth delivery and customs processing. If the information is incomplete or incorrect, the parcel may be delayed or placed on hold, as customs authorities rely on precise recipient data to clear international shipments.

What import costs need to be paid?

Bringing goods into a country is subject to customs regulations and related fees. The amount payable is calculated by customs authorities based on elements such as the declared shipment value, the nature of the items, and their country of origin.

To determine the correct rate, customs officials rely on the Harmonized System (HS) classification code assigned to each product. Applicable costs can include import VAT, customs tariffs, and administrative or processing fees. These amounts must usually be settled before the shipment is released for delivery.

Beyond duties and taxes, a separate customs processing or brokerage fee is often applied.

What is a clearance fee, and who pays it?

A customs clearance charge is a fee billed by the customs broker for handling the formalities required to release goods through customs control. It reflects the administrative work and compliance checks necessary to ensure shipments meet all relevant import or export regulations.

Who pays this charge depends on the GLS Incoterms agreed for the shipment. These international trade terms outline the responsibilities of both seller and buyer, specifying which party is liable for costs related to customs procedures.

What do I need to send Parcel cross border?

When sending a parcel to the United Kingdom, certain customs details must be provided to ensure proper processing:

- HS Code: The Harmonized System classification number that identifies the goods for customs assessment.

- EORI Number: The Economic Operators Registration and Identification number needed for customs procedures.

- Country of origin: The nation where the products were manufactured or produced.

- Complete contact information for both sender and recipient: Full name, address, email address, and telephone number.

Submitting accurate and comprehensive data helps prevent customs delays, additional fees, or shipment holds.

What are HS Codes (commodity code)?

HS codes, also known as Harmonized System codes, are standardized numerical classifications used worldwide to identify products in international trade.

When shipping goods outside the European Union, each item in the consignment must be assigned the appropriate HS code. Customs authorities rely on these codes to determine the nature of the goods and to assess the relevant duties and taxes.

For export shipments, the HS classification generally contains eight digits. Supplying the correct code in the shipment data provided to GLS supports accurate customs handling. Authorities use this classification to verify the contents of the parcel and calculate any applicable charges. Ensuring the accuracy of the HS code is key to avoiding delays and maintaining compliance in cross-border shipping.

How do I get the correct commodity codes for products?

To classify products accurately for international shipping, each item must be assigned the appropriate HS (Harmonized System) code.

You can determine the correct code in two main ways:

- Use the official tool provided by tax or customs authorities, such as the TARIC consultation tool, which allows searching by product name or category.

- Utilize GLS’s Customs Portal, which guides you in selecting the correct HS code by entering your product description while preparing your shipment.

What is an EORI Number and why do I need it?

An EORI number (Economic Operators Registration and Identification) is a unique identifier necessary for customs clearance within the European Union. Businesses sending or receiving goods across EU borders must have an EORI number, and it is also recommended for individuals involved in regular international trade.

EORI number structure:

- It starts with the country code of the EU member state where the company is registered (e.g., ES for Spain, DE for Germany).

- This is followed by a unique combination of letters and/or numbers that identifies the business or trader.

Providing a valid EORI number helps ensure customs processes run smoothly and prevents shipment delays or rejections.

How are duties and taxes calculated?

Customs duties are fees charged on imported goods by authorities to regulate trade, protect domestic industries, and generate government revenue. Duty rates are calculated as a percentage of the customs value and vary depending on several factors:

- The nature of the goods being imported

- The country of origin

- Any applicable trade agreements between countries

Taxes, in a customs context, generally refer to import VAT and other levies. Import VAT corresponds to the standard VAT rate of the destination country. For instance, in Germany, the standard VAT is 19%, with a reduced rate of 7% for specific items such as food and books.

How can I pay for duty and tax amounts generated during the Customs clearance?

Recipients responsible for paying duties and taxes will be notified by GLS/Royal Mail via email or SMS. The message contains a link to the payment platform, where outstanding customs charges can be paid securely using a credit card or open banking.

What are GLS Incoterms?

GLS Incoterms specify the obligations of buyers and sellers regarding customs-related costs for international shipments. Within the GLS framework, there are three main types of charges to consider:

- Clearance Fee – The fee charged by the customs broker for managing the clearance process.

- Duties – Government-imposed tariffs on imported goods.

- Taxes – Including VAT or other applicable import levies.

The chosen GLS Incoterm determines which party is responsible for each cost. Understanding the Incoterm for your shipment clarifies who bears the charges and ensures smooth customs handling.